Priced Out: TD Housing Hard To Come By

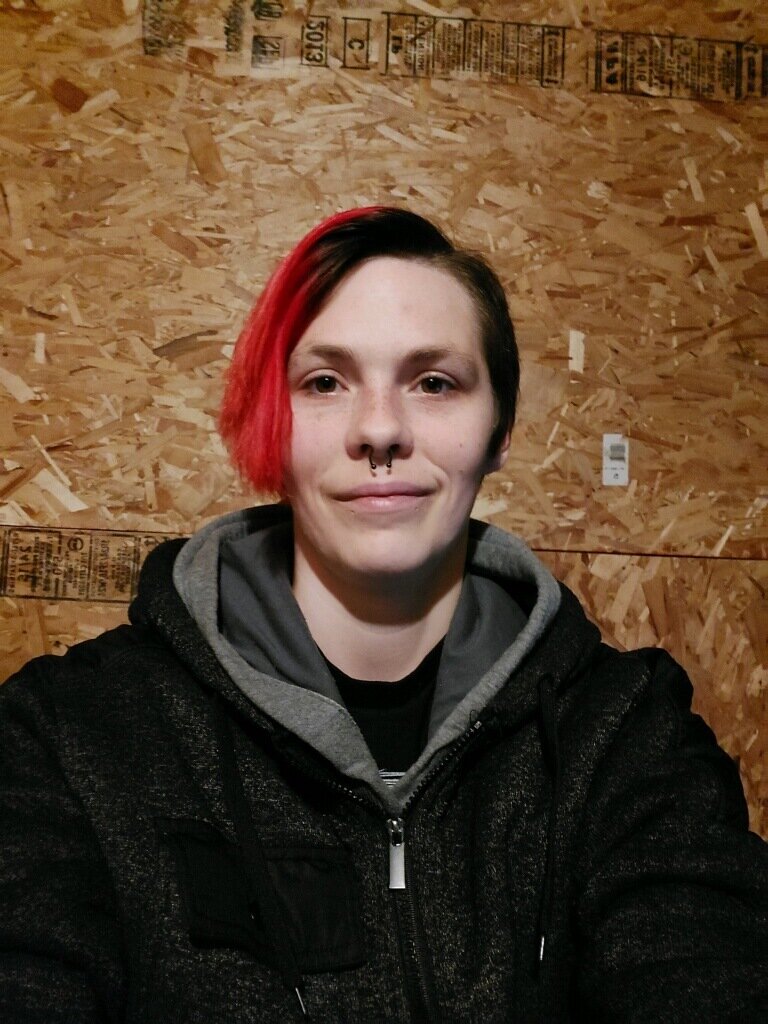

Elizabeth Marzillo, 29, even armed with a HUD Voucher for $869, was unable to find housing. She’s been looking for two years.

By Tom Peterson

“I have lived in my car. I have lived in a tent. I have slept on the streets. I just recently started staying with my sister, and I have couch hopped a couple of times,” said Elizabeth Marzillo last week.

She is 29 and single.

She has been looking for a rental in The Dalles for two years.

She’s still looking.

She thought her luck turned in the fall when a housing voucher for $869 a month came through at Mid Columbia Housing Authority.

“I put my name on the list a long time ago, and it finally came through,” she said. “I called every single apartment property management company in The Dalles looking for a place. It was really hard. I could not find anything at all.”

She said deposits, her income as a service worker, and her single status all were barriers to her finding a home.

Even after getting an extension, her voucher still expired on Dec. 16.

“I’ve been very discouraged for the last year, but it really hit when I lost my HUD voucher. I thought that would make the difference.”

How Could That Be?

“The biggest problem right now is there is not enough housing. Trying to find something in that price range was next to impossible - $869 for a one-bedroom - most places in The Dalles are $900 to $1,500 for a one-bedroom.”

Problem is Statewide

Realtor Jim Wilcox with Columbia River Properties, who has been pushing for more housing stock since the early 2000s, recently pointed out that Oregon as a whole has lagged on keeping up with housing for decades.

The problem is now demonstrable in the number of people living in their cars or on the street because, in some instances, they cannot afford to do otherwise.

Wilcox said the state needs to build 30,000 units of housing every year for the next 20 years to catch up. Right now, that number stands around 17,000, he said.

Local Rental Market

A recent survey of rentals demonstrates where the market currently sits.

The survey, done in January, took in all of the available rentals via internets searches and revealed 22 available residential rentals in Wasco County, including 15 multi-family units (duplex and greater) and 9 single-family rentals. All but two of those units were within The Dalles City limits, with one unit available near The Dalles in unincorporated Wasco County and one unit in Dufur.

3 Studio apts. - 200-420 sq. ft., average rent $678/mo.

5 one-bedroom apts. - 540 -750 sq. ft., average rent $1134/mo

10 two-bedroom apts.- 735 to 1652 sq. ft., average rent $1258/mo.

4 three-bedroom apts. - 1579 to 2100 sq. ft., average rent $1792/mo.

1 four-bedroom, no sq. ft. listed, $1774/mo

A family of four, with two adults earning $15 an hour with two children, would pay some $21,500 of their income on rent for a three-bedroom apartment before paying any utilities. They can net $48,000 after taxes and a three-bedroom apartment would take $21,500, leaving $26,500 for utilities, car payments, food, healthcare, childcare and contingencies. It would not take much for this family to fall in the red during the course of a year.

Local Approach

Lawmakers and local leaders are aware of the situation.

On Monday night, The Dalles City Council discussed Oregon House Bill 2001 allowing for duplexes to be built on all residential lots to increase local housing stock.

New Community Development Director Alice Cannon said the law came with funding to streamline the approval process for multi-unit housing.

A survey has been set up to assist in gathering input from the community in regard to the law. Click here to take it: https://arcg.is/fPrPX.

“The Dalles has been very compliant with current regulations from the State,” Cannon said, noting work done in 2019 addressed the requirements ahead of time. The City has also financially encouraged rehabilitation of second-story apartments in buildings downtown, allowed for additional dwelling units on residential lots, and generally relied on infill for additional housing units.

Landlocked

The problem in The Dalles is compounded by physical constraints.

Columbia River Gorge National Scenic Area Commission, which governs land use in the gorge, has limited The City of The Dalles to a total expansion of “50 acres forever,” during meetings held in August.

Essentially, the city is landlocked within the urban growth boundary.

It’s a simple issue of supply and demand. Less land and fewer rentals equal higher prices.

Higher Prices, Higher Rent

For example, the average home price in The Dalles in January was $308,000.

As a buyer, look at the cost to break even on a home rental.

Finance that $308,000 home at 20 percent down with a commercial lending rate of 4 percent on a 30-year fixed loan, and the payment is $1176. Throw in insurance, taxes, maintenance and some utilities and it's easy to come to $1,900 monthly to just break even- barring no major repairs or damage. As a landlord, you’re under pressure to pay the mortgage, so you need some security.

Would you want guarantees from a renter - such as first and last month's rent?

Priced Out

But those prices don’t work for thousands in our community. The Dalles is a regional shopping and service center, with many employees at the lower end of the pay scale.

Forty-six percent of the workforce, or 5,700 in Wasco County work in Service, by far the largest sector - retail trade comes in a distant second at 20 percent. To look at the stats: Click here.

At $13 an hour at 30 hours a week, an employee can gross $1,716 a month and net $1,339.

Hard To Come Up With The Down

“Landlords ask applicants if they have three times the amount of rent in their monthly income. And a person earning minimum wage does not have that,” Marzillo said, adding most minimum wage jobs don’t offer full-time hours. It takes multiple jobs to meet the threshold.

“I’m still staying with my sister and have not found a place,” Marzillo said, noting she was applying at Petco and Msfitz for work, hoping to up her income.

Jeff Rahier and a roommate were able to put down the $1,900 to get this home rental in The Dalles last week. Rahier, a manager at AutoZone, spent a year living out of his pickup and living with friends before finding a place he could afford.

Jeff Rahier, who moved into a rental home just last week, said the down was the hardest part. “They are wiling to rent,” he said. “But you have to have an absolute verified income. I saw a place in Mosier; they wanted $3,275 to move in. That was a trailer with two bedrooms.”

“That’s really extreme,” he pointed out. But he said the 800-square-foot house he was moving into was $1,900 in rent and deposits for the first month. He is renting it with a friend.

And he’s happy to have it.

“We got keys to the place yesterday,” he said last week. “It's really emotional. I have been homeless for about a year due to the unfortunate events of last year.”

Rahier lost his work in deliveries and went through a divorce. He used to own a three bedroom two bath home in Longview, Wash., with a mortgage of $900 a month. Banks repossessed his pickup.

That’s all gone now.

Friends in The Dalles told Rahier there was work here, and they welcomed him into their home to stay.

The 38-year-old landed a job as a manager at AutoZone.

“I need to get a second job,” he said. “I am going to have $20 in this paycheck to spend and the rest is going toward rent.”

“I did minimum wage in my 20s,” he added. “I moved up, and I was at an industrial cardboard mill in Longview. I was living in my own home. I did not have to worry about food. I did not have to worry about the internet, phones and power being shut off.”

Tough All Over

“It’s tough all over,” Rahier added. “Rental places are hesitant to let people get in because they are getting screwed. Renters are staying but not paying because they can’t be evicted. A lot of (landlords) are out money and waiting for people to pay.”

“Between 12% and 15% of renters statewide have become delinquent on their payments since the pandemic lockdowns were instituted, according to industry advocacy group Multifamily NW. A small study out of Portland State University found that 166 renters – 35% of those surveyed – owed missed or late rent,” According to a story in the Corvallis Advocate.

CCCNews spoke with several landlords for this story.

Essentially, they said rights are in favor of renters. They have lost control of rental properties as they have lost the tool to evict for nonpayment of rent.

“The changes to rental laws during the past five years as well as COVID have made owning rentals a risk worth little reward,” was one comment.

House Bill 4401 prompted by Coronavirus prevents evictions for nonpayment through June 31, 2021, according to an Oregon Rental Housing synopsis.

A Little Hope

Charlie Foote

Loca Realtor, Charlie Foote partners in several rentals here in The Dalles. He said there are some local programs that can help the housing situation.

He financed a project through the Mid-Columbia Economic Development District to rehab a six-apartment building with the goal of setting rents in the “attainable housing” range. He said the low-interest loan made the project possible.

“They made it easy,” he said. “It was not like a traditional construction loan. It helped our project significantly.”

The six-plex with squatter issues was transformed, he said, noting it was completed in Spring of 2020 and all units are now rented.

Relief For Landlords, Kind Of

“In August, Gov. Kate Brown extended the state’s moratorium on foreclosures through the end of the year, providing a lifeline to property owners (such as landlords) willing to negotiate a forbearance with their lenders. Those in forbearance are not allowed to refinance and must work out repayment plans with their banks,” according to a story in OregonLlive.

“Although the state moratorium ended, rental owners may still be eligible for mortgage relief.

The foreclosure moratorium for federally backed mortgages is in effect through Feb. 28, 2021.

Mortgages backed by Fannie Mae or Freddie Mac cannot foreclose until Feb. 28, 2021.

For all other types of mortgages, lenders may begin foreclosure processes under Oregon law.

If an in-process foreclosure was put on hold because of the moratorium, it can proceed from that point. Lenders are required to send an amended notice of default to the homeowner that provides updated foreclosure dates.,” according to Oregon.gov

However, that does not address utility charges, property taxes and maintenance costs for the rental properties. Those bills continue to come due for landlords.

Chasity Jeffers

$2,000 To Move - No Thanks

Chasity Jeffers said she was “freaking out” when it became apparent she would have to find another place to live in December.

The 42-year-old native of The Dalles is on disability and uses a wheelchair because of arthritis in her knees. She has a one-bedroom apartment on Court Street.

She can’t live just anywhere. She needs ground level access and no stairs.

“I put in three or four applications at apartment complexes and checked all the websites constantly and called a few,” she said. “They were either too high (expensive), have stairs or do not accept HUD. So I was freaking out, thinking I would be homeless.”

Applications cost $35 to $40 to submit - the expense was adding up.

Jeffers said agencies assisting her with trying to find a new apartment suggested other towns. “They want us to find places in Goldendale or Dufur. I am disabled. I do not want to move somewhere else. I don’t want to move out of The Dalles.”

Jeffers was looking for the apartment because a new owner had taken possession of her current apartment building and was asking people to move out by March.

“He came around telling us we needed to move because it would not be safe while renovations were occurring because of asbestos removal. He wanted us to sign a paper in a package deal to move out by March,” she said. “And he was going to raise rents from $800 to $1,400. The landlord was offering $2,000 to residents willing to move.

Jeffers said she refused to sign and contacted an attorney, Marcus Swift.

“A lot of people did sign it,” she said.

“I said $2000 does not mean anything to me to go out and rent a place,” she said.”I can’t get into a place. If you call and look, there is not much you can do. I could not even find a dump, let alone a decent place. I have a good rental history. I don’t destroy anything. I get comments on how well I keep his place.”

“I still do my own dishes, vacuum. I’m 42. Still strong. I can’t stand. So everything is difficult.

Swift told Jeffers that she could not be evicted.

“I wrote him (the apartment owner) an email,” she said. “He came back the following Monday and apologized, and told me I would not be getting an eviction and I would get the $2,000 when I move.”

She still hopes to work a deal with the owner based on her ability to pay.

Jeffers said she felt like she was “treated like the homeless. They want the low-income people out of this town. It was so nice that Marcus treated me like I was somebody, not just garbage - I was shocked to tell you the truth.”

“I am not a nobody - I worked at Headstart. I raised a daughter. I got arthritis in my knees and it crippled me, and I am just kind of stuck right now.”